Journal Entry for Issuing Common Stock for Service

Journal Entry for Issuing Common Stock for Service is sometimes complicated when accountants have to consider for the fair value of stock. In this section, we discuss two different ways to record issuance of common stock for service.

When company start operation, some legal assistance are needed from attorneys. Sometimes, companies do not have enough cash to pay. In that case, the attorney may agree to accept certain number of shares in exchange.

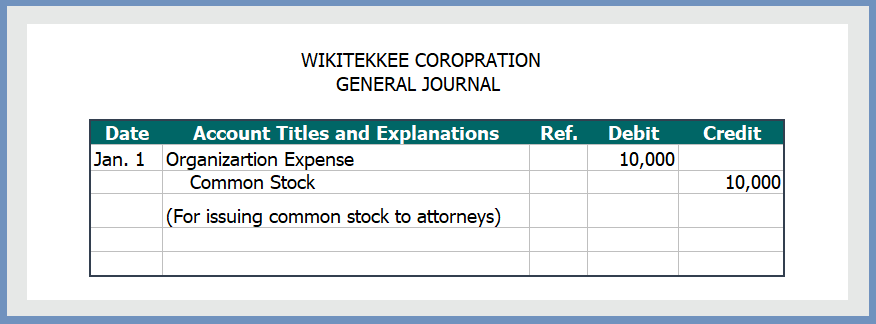

Example 1: Common Stock with NO PAR Value:

An attorney has helped Wikitekkee at the time of starting the company. The attorney billed the company $10,000 for her services. She agreed to accept 1,000 shares of $10 each in payment of her bill. The stock is a no par value. The journal entry is:

Organization Expense————-Dr. 10,000

Common Stock—————————-Cr. 10,000

Example 2: Common Stock with Par Value:

An attorney has helped Wikitekkee at the time of starting the company. The attorney billed the company $10,000 for her services. She agreed to accept 800 shares of $10 par value common stock in payment of her bill. At the time of the exchange, there is not established market price for the stock, and the fair value of the consideration of $10,000 is clearly evident. The journal entry is:

Organization Expense———-Dr. 10,000

Common Stock————————————–Cr. 8,000

Paid-in-Capital in Excess of Par–Common Stock—Cr. 2,000

Related Readings: