Adjusting the Accounts

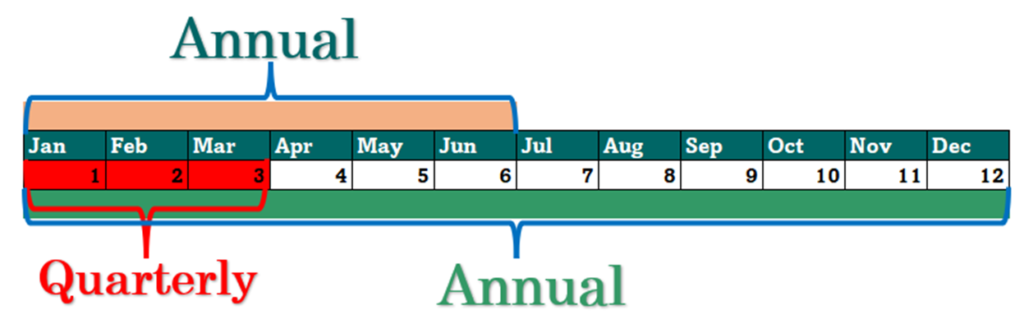

Adjusting the accounts is required in accounting because of matching, periodicity, and revenue recognition principles. In order for revenues to be recorded in the period in which services are performed and for expenses to be recognized in the period in which they are incurred, companies make adjusting entries. Adjusting entries ensure that the revenue recognition and expense recognition principles are followed.

In this section:

- Adjusting Entry

- Recognizing Revenue and Expenses

- Why do we need to adjust the accounts?

- Types of Adjusting Entries

- Prepaid Expense–Example

- Unearned Revenue–Example

- Accruals

- Accrued Revenue–Example

- Accrued Expense–Example

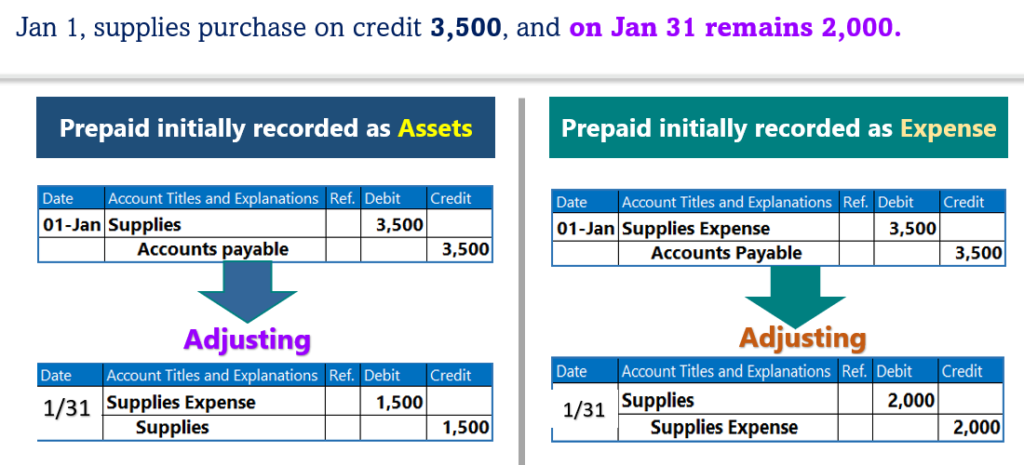

- Alternative Treatment of Adjusting Entry

1. Adjusting Entry:

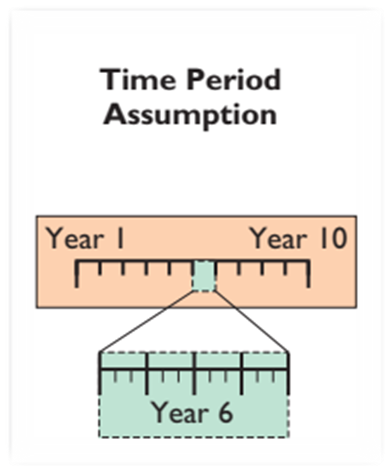

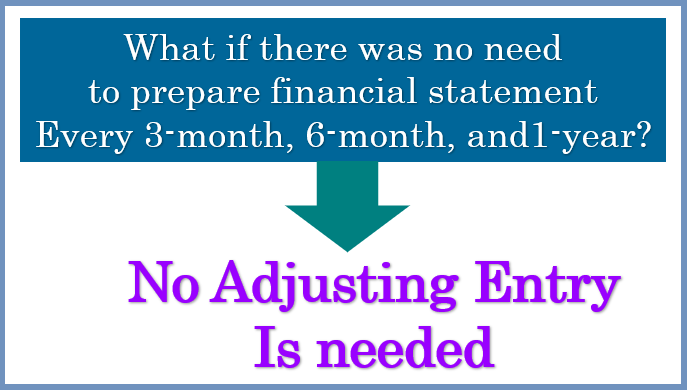

If we could wait to prepare financial statements until a company ended its operations, no adjustments would be needed. At that point, we could easily determine its final balance sheet and the amount of lifetime income it earned.

•Companies need immediate feedbacks about how well they are doing.

•IRS requires all businesses to file annual tax returns.

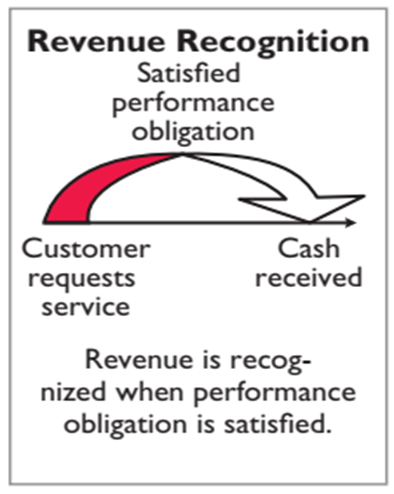

2. Recognizing Revenues and Expenses:

When a company agrees to perform a service or sell a product to a customer, it has a performance obligation. When the company meets this performance obligation, it recognizes revenue. The revenue recognition principle therefore requires that companies recognize revenue in the accounting period in which the performance obligation is satisfied.

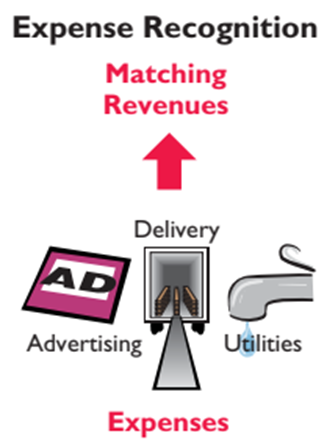

Expense Recognition:

Accountants follow a simple rule in recognizing expenses: “Let the expenses follow the revenues.” This practice of expense recognition is referred to as the expense recognition principle (often referred to as the matching principle). It dictates that efforts (expenses) be matched with results (revenues).

3. Why do we need to adjust accounts?

In order for revenues to be recorded in the period in which services are performed and for expenses to be recognized in the period in which they are incurred, companies make adjusting entries. Adjusting entries ensure that the revenue recognition and expense recognition principles are followed.

The trial balance may not contain the up-to-date and complete data. This is true for several reasons:

1.Not recorded DAILY: Think about Supplies Expense

2.Expenses are not recorded during the accounting period: Think about depreciation and insurance expense.

3.Unrecorded items: Think about utility bill.

Adjusting entries are required every time companies prepare financial statements.

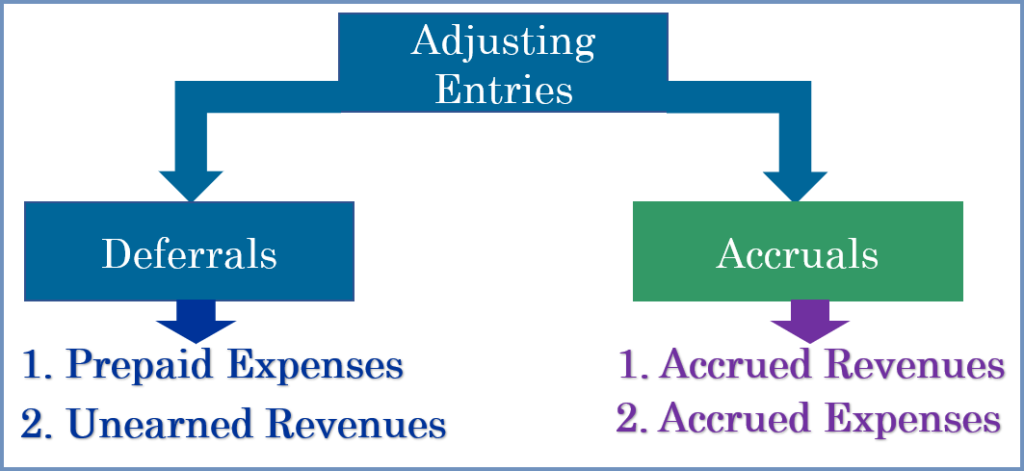

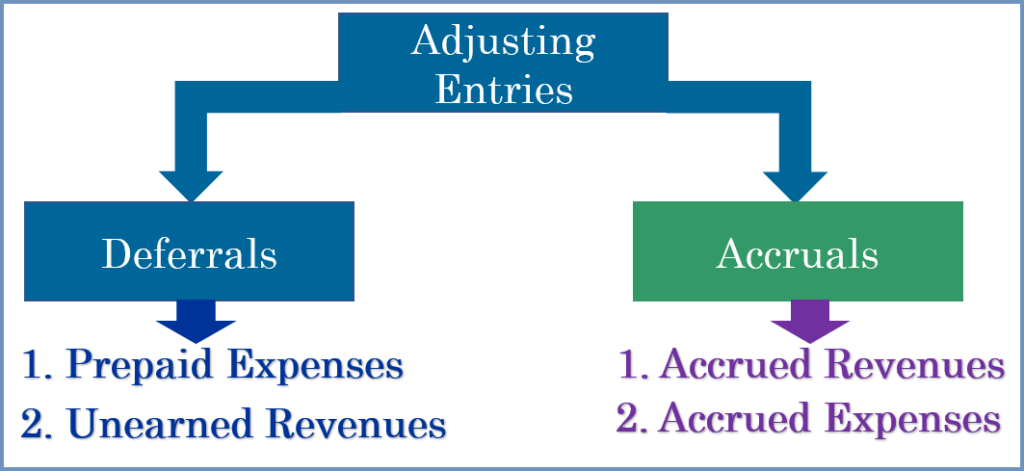

4. Types of Adjusting Entries:

There are mainly two types of adjusting entries:

Deferrals:

To defer means to postpone or delay. Deferrals are expenses or revenues that are recognized a date later than the point when cash was originally exchanged.

Two types of deferrals are:

1.Prepaid Expenses

2.Unearned Revenues

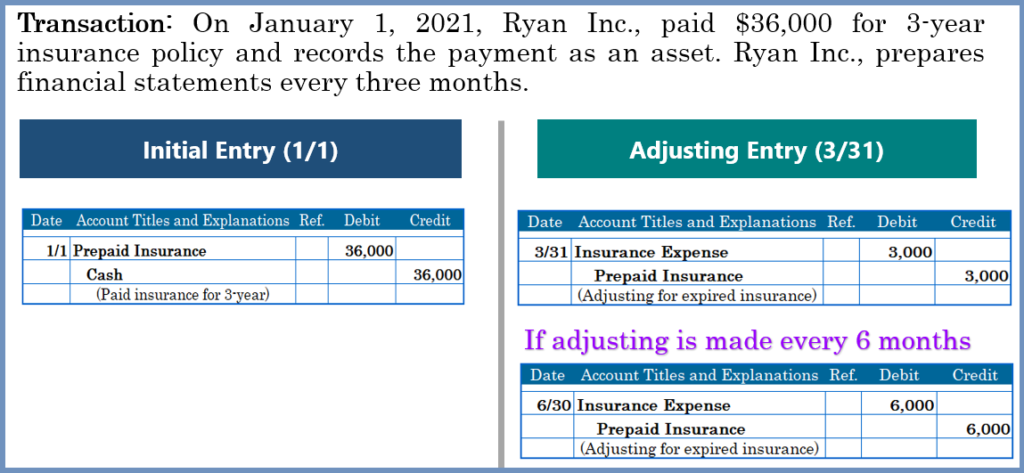

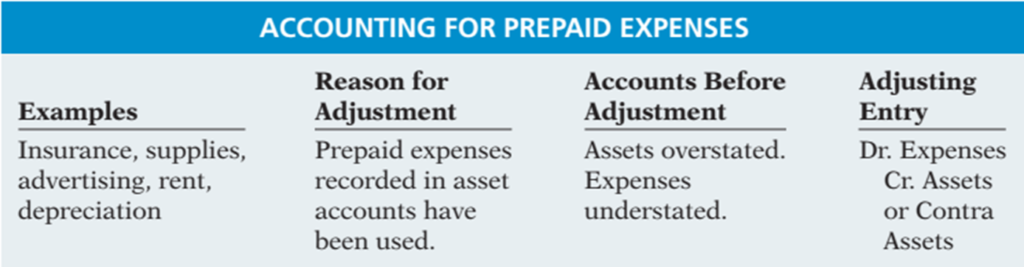

5. Prepaid Expense-Examples:

When companies record payments of expenses that will benefit more than one accounting period, they usually record an asset called “Prepaid Expenses” or “Prepayments”.

Examples:

Prepaid Insurance

Prepaid Rent

Prepaid Advertising Expense

Supplies Tangible Assets

Reasons for Adjusting Prepaid Expenses:

6. Unearned Revenue-Examples:

When companies receive cash before services are performed, they record a liability by increasing a liability account called Unearned Revenues.

Examples of companies that record unearned revenues:

Airlines—Unearned Revenues from selling tickets in advance.

Realtor—Unearned Rent Revenues for receiving advanced rent.

Magazine—Unearned Subscription Revenue for receiving advance subscription fees.

7. Accruals:

The second category of adjusting entries is accruals. Prior to an accrual adjustment, the revenue account (and the related asset account) or the expense account (and the related liability account) are understated. Thus, the adjusting entry for accruals will increase both a balance sheet and an income statement account.

There are two types of Accruals:

1.Accrued Revenues

2. Accrued Expenses

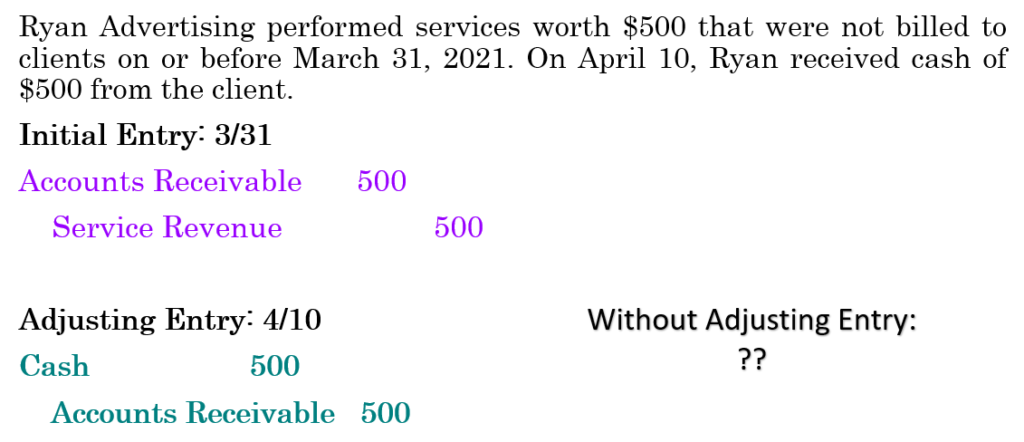

8. Accrued Revenue-Example:

Revenues for services performed but not yet recorded at the statement date are accrued revenues.

An adjusting entry for accrued revenues results in an increase (a debit) to an asset account and an increase (a credit) to a revenue account.

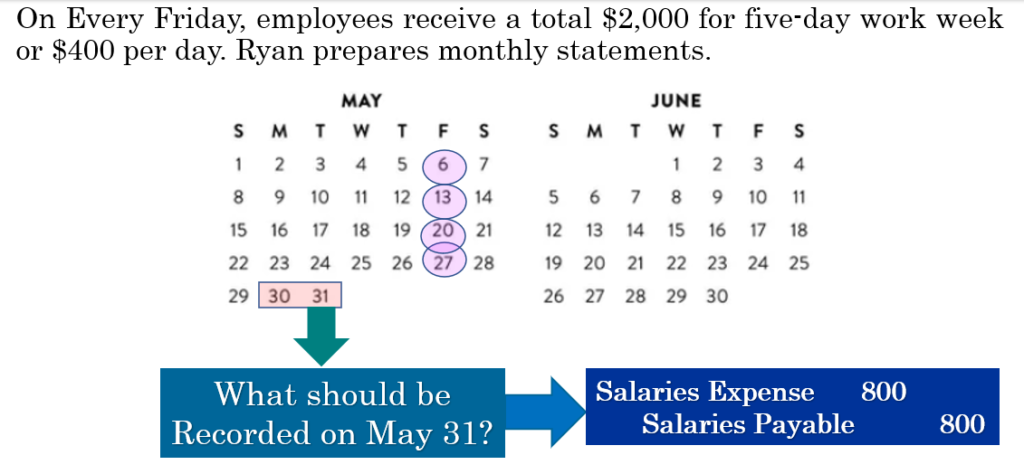

9. Accrued Expense-Example:

Expenses incurred but not yet paid or recorded at the statement date are called accrued expenses. Interest, taxes, and salaries are common examples of accrued expenses.

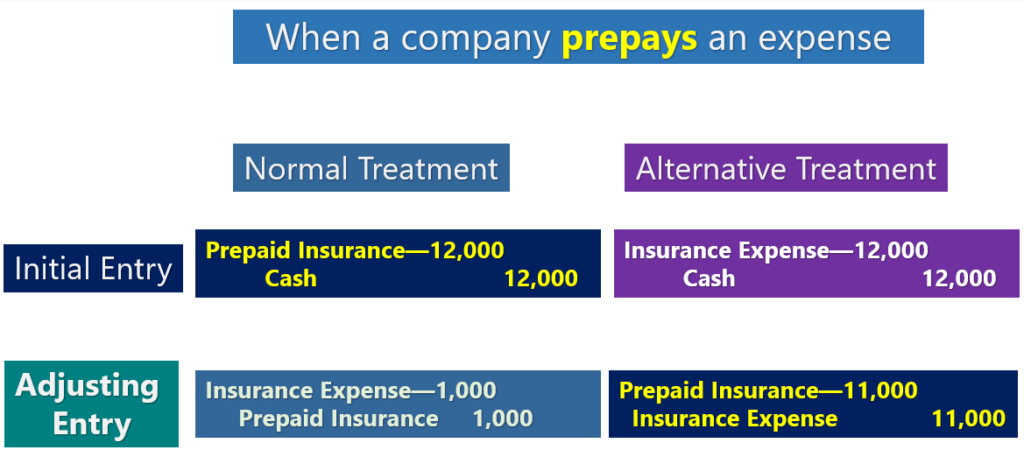

10. Alternative Treatment of Adjusting Entry:

Further Readings: