How to Make Debit and Credit in Accounting

Under the double entry system of Accounting, every transaction affects at least two accounts–one of them is debited and the other one is credited. Be able to make debit and credit of affected accounts is the fundamental quality of accountants. In this section, we will discuss the easiest way to make debit and credit, and the end of the section, we will solve some basic problems on making debit and credit.

In this section:

- The Basic Form of Account

- Debit and Credit

- Examples of Different Types of Accounts

- Golder Rules of Debit and Credit with Examples

- A Customized Rules for Making Debit-Credit

- Problems and Solutions

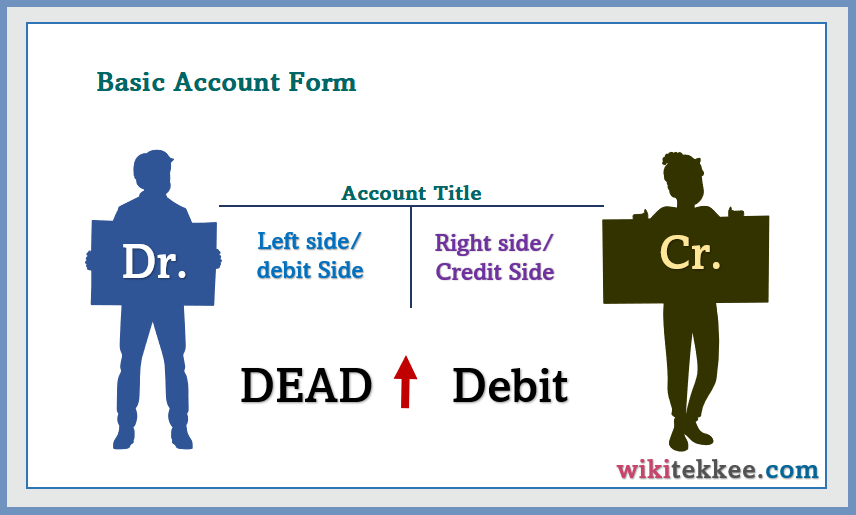

1. The Basic Form of Account:

An Account is a record in accounting system. It records the increase or decrease in the assets, liabilities, expenses, revenues, and owners’ equity. Amazon, for example, have separate accounts for Cash, Sales Revenues, Salaries and Wages Expenses, Accounts Payable, and so on. Normally, the account looks like a T because the basic form of account is also formatted as T. An account has three parts, namely

(1) The Title of the Account,

(2) The Debit or Left Side of the Account, and

(3) The Credit or Right Side of the Account.

2. Debit and Credit in Accounting:

The T-Account is a ledger account that is used to understand the effects of one or more transactions on the accounts. The T-Account came from the shape of the account, which looks like a T.

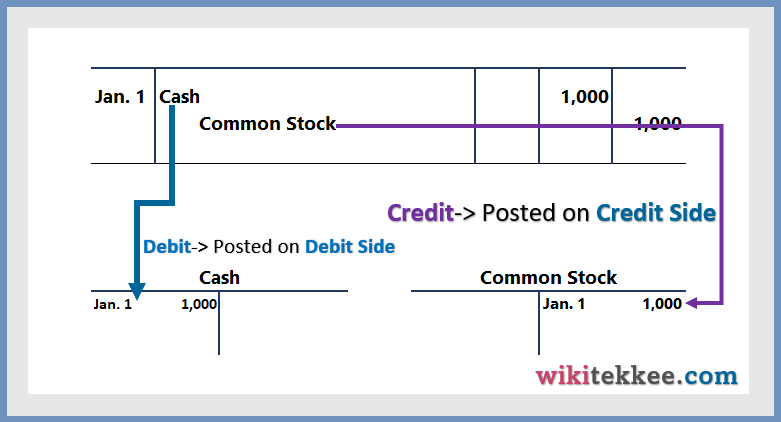

The left side of an account is called Debit and the right side is called Credit. The Debit is abbreviated as Dr. and the Credit is abbreviated as Cr. When we enter an amount on the left side or debit side of an account, we actually debit that account. For example, if the journal entry is “Dr. Cash–1,000 and Cr. Common Stock–1,000, then we enter an amount of $1,000 on the left side of Cash account. [See the image]. Similarly, entering an amount on the credit side is to credit to the account.

Note:

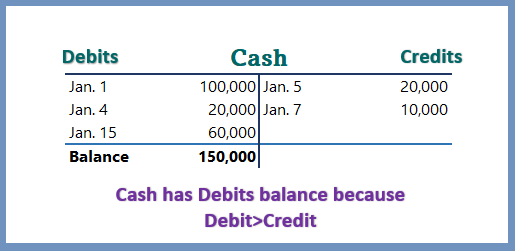

There is a common myth that debit means increase and credit means decrease. Please do NOT be confused with this myth. Whether increase or decrease means debit or credit depends on the account types. Assets, for example, increase means debit; however, liability increase means credit. We will discuss in the next section on how to make debit and credit of different types of accounts. The balance of an account is the difference between its debit and credit sides. If the debit side amount is greater than its credit side amount, the balance is debit and vice versa.

3. Examples of Different Types of Accounts

There are mainly three types of accounts:

- Assets:

- Assets are the resources that is owned and controlled by an entity and has probable future economic benefits. Assets are classified in different ways. The most common types of assets in a business entity are:

- Current Assets:

- Cash and Cash Equivalents

- Accounts Receivable

- Prepaid Expenses

- Notes Receivable

- Supplies

- Marketable Securities

- Inventory

- Short-term Investments

- Long Term Assets-Property, Plant, and Equipment:

- Property, Plant, and Equipment

- Building

- Land

- Furniture

- Long-term investments

- Intangible Assets:

- Trademarks

- Brand Recognition

- Goodwill

- Patents

- Current Assets:

- Assets are the resources that is owned and controlled by an entity and has probable future economic benefits. Assets are classified in different ways. The most common types of assets in a business entity are:

- Liabilities:

- Liabilities are the obligations of an entity arising from past event, the settlement of which is expected to result in an outflow from the entity of resources embodying economic benefits.

- Current Liabilities:

- Accounts Payable

- Notes Payable

- Unearned Revenue

- Salaries and Wages Payable

- Unearned Rent Payable

- Interest Payable

- Long-term Liabilities:

- Long-term Debt

- Long-term Notes Payable

- Current Liabilities:

- Liabilities are the obligations of an entity arising from past event, the settlement of which is expected to result in an outflow from the entity of resources embodying economic benefits.

- Owners’ Equity:

- Owners’ equity is the residual interest in the asset of the entity after deducting all of its liabilities. Owners’ equity (OE) is increased by additional investment by the owners and increase in revenues, and OE decreases if the owners withdraw money from business, take dividend, and by increase in expense.

- Revenues:

- Sales Revenue

- Service Revenue

- Interest Revenue

- Rent Revenue

- Expenses:

- Cost of Goods Sold

- Salaries Expense

- Rent Expense

- Advertising Expense

- Interest Expense

- Depreciation Expense

- Supplies Expense

- Utilities Expense

- Insurance Expense

- Amortization Expense

- Bad Debt Expense

- Revenues:

- Owners’ equity is the residual interest in the asset of the entity after deducting all of its liabilities. Owners’ equity (OE) is increased by additional investment by the owners and increase in revenues, and OE decreases if the owners withdraw money from business, take dividend, and by increase in expense.

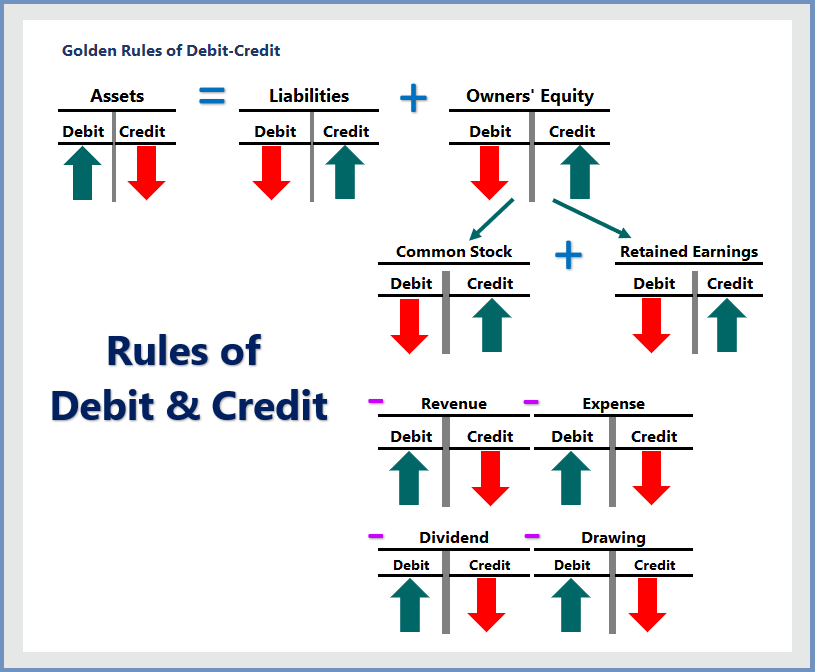

4. Golden Rules of Debit and Credit:

The golden rules of debit-credit is shown in the following image.

Examples of Debit-Credit:

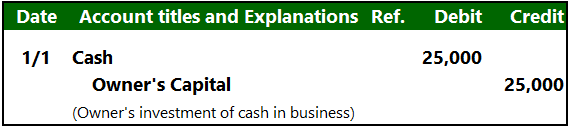

Example 1: January 1, 2022, Mr. Rich Brody invested $25,000 cash in the business.

Step 1: Analyze the types of Accounts:

Cash–> Asset Account

Owner’s Capital--> Owner’s Equity

Step 2: Determine Debit-Credit:

Cash–> Increase –> Debit

Owner’s Capital –> Increase–Credit

Step 3: Prepare journal entry:

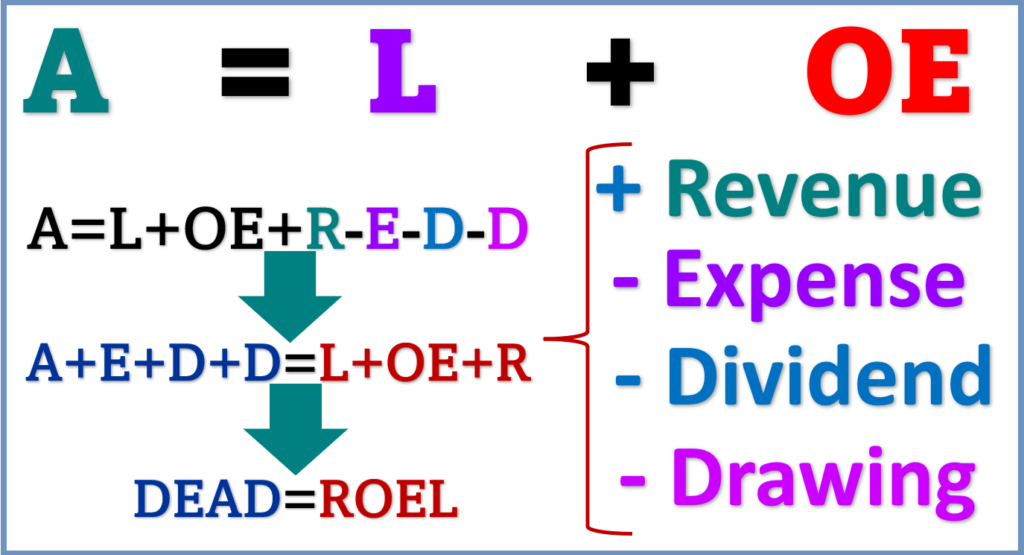

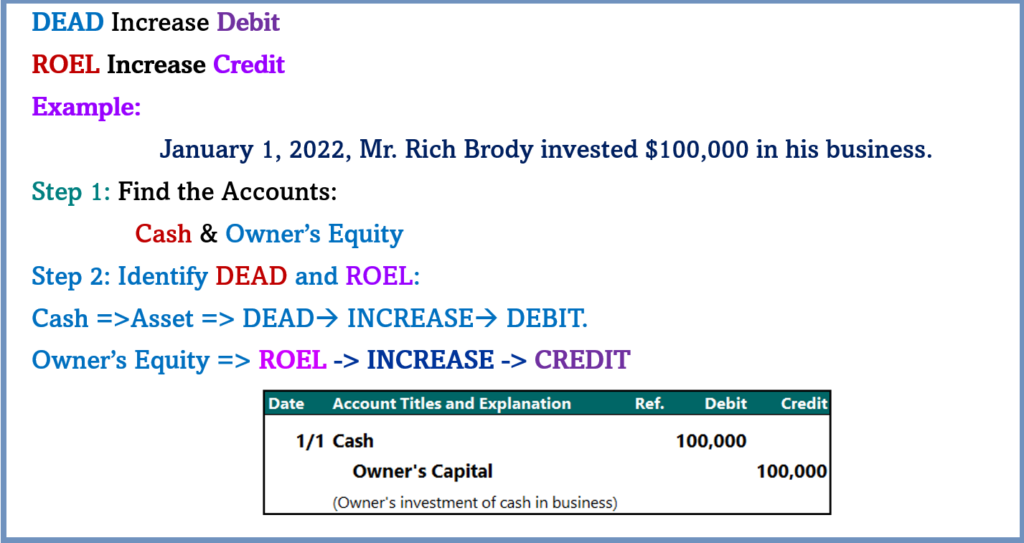

5. Customized Rules of Debit-Credit:

Let’s first see the accounting equation:

Explanation: Suppose, we want to start a business, and we need $10 Million dollar to start. We have only $8 Million dollar. This $8 million dollar supplied by the owners is called capital–Owners’ Equity (OE). We borrowed the remaining $2 million from outsider (they). This $2 million dollar is called liability (L).

Now, the business has total $10 million dollar. This $10 million dollar is called Assets (A).

If we write the equation, it would be:

10 = 8+2 => 10=2+8 => Assets = Liability + Owners’ Equity.

Let’s extend the equation:

The customized formula for Debit and Credit:

6. Problems and Solutions:

Let’s solve the following question:

During January 2022, the following transaction occurred for the Wikitekkee Corporation.

- Wikitekkee issued 32,000 shares of common stock in exchange for $320,000 in cash.

- Wikitekkee purchased equipment at a cost of $32,000. $12,000 cash was paid and a note payable to the seller was signed for the balance owed.

- Wikitekkee purchased inventory on account at a cost of $120,000. [Be informed that Wikitekkee uses the perpetual inventory system.

- Wikitekkee sold total $130,000 on credit. The cost of the goods sold was $60,000.

- Wikitekkee paid $4,000 in rent on building for the month of January.

- Wikitekkee paid $72,000 to an insurance company for fire and liability insurance for a one-year period beginning February 2022.

- Wikitekkee paid $90,000 on account for the merchandise purchased in 3.

- Wikitekkee collected $80,000 from customers on account.

- Wikitekkee recorded depreciation expense of $3,000 for the month on the equipment.

Required:

Prepare journal entries for each of the transaction listed above.

Answer:

More related readings:

One Response